All Categories

Featured

Table of Contents

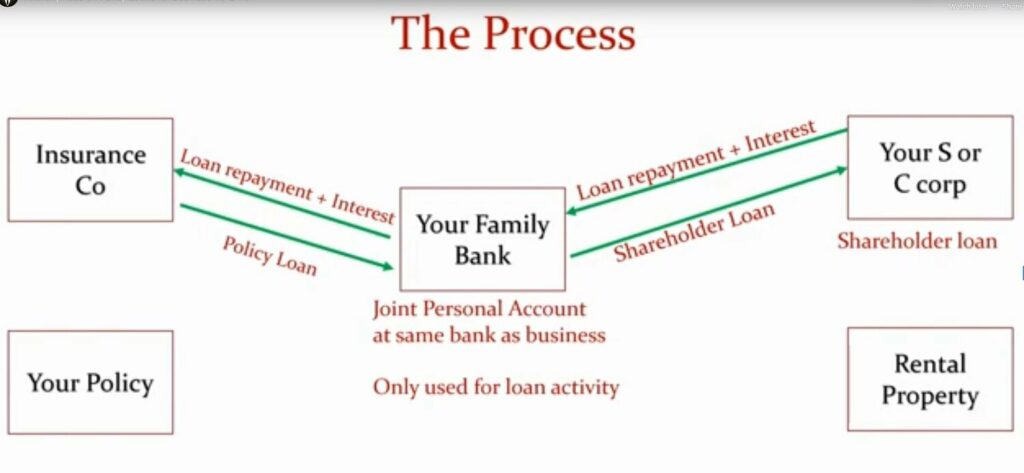

The strategy has its own advantages, however it also has problems with high charges, intricacy, and extra, causing it being related to as a rip-off by some. Boundless banking is not the finest policy if you require only the investment element. The boundless banking principle revolves around making use of entire life insurance policy policies as a monetary tool.

A PUAR permits you to "overfund" your insurance coverage policy right up to line of it becoming a Changed Endowment Agreement (MEC). When you use a PUAR, you swiftly raise your cash money worth (and your survivor benefit), thus raising the power of your "bank". Additionally, the even more money value you have, the higher your interest and returns payments from your insurance policy company will be.

With the increase of TikTok as an information-sharing system, economic guidance and techniques have actually located an unique means of spreading. One such technique that has actually been making the rounds is the limitless financial concept, or IBC for brief, garnering recommendations from celebrities like rap artist Waka Flocka Fire - Wealth building with Infinite Banking. While the approach is currently popular, its origins map back to the 1980s when economist Nelson Nash introduced it to the world.

How can Infinite Banking Vs Traditional Banking reduce my reliance on banks?

Within these policies, the cash money worth grows based on a price set by the insurer. When a considerable money worth collects, insurance policy holders can obtain a money value loan. These financings differ from traditional ones, with life insurance policy functioning as collateral, suggesting one can shed their coverage if loaning exceedingly without sufficient cash money value to support the insurance coverage prices.

And while the appeal of these plans is noticeable, there are innate limitations and threats, demanding diligent cash money value monitoring. The technique's authenticity isn't black and white. For high-net-worth people or company owner, particularly those using strategies like company-owned life insurance policy (COLI), the benefits of tax breaks and substance development can be appealing.

The appeal of boundless financial doesn't negate its obstacles: Price: The foundational requirement, a permanent life insurance policy, is costlier than its term equivalents. Eligibility: Not every person qualifies for entire life insurance policy due to extensive underwriting procedures that can leave out those with particular wellness or lifestyle problems. Intricacy and risk: The intricate nature of IBC, paired with its threats, may hinder numerous, especially when simpler and much less dangerous options are readily available.

What resources do I need to succeed with Privatized Banking System?

Alloting around 10% of your month-to-month revenue to the plan is just not possible for many people. Using life insurance as a financial investment and liquidity resource needs technique and tracking of plan cash money worth. Seek advice from an economic expert to identify if infinite financial aligns with your priorities. Part of what you read below is merely a reiteration of what has currently been stated over.

Before you get on your own right into a situation you're not prepared for, know the complying with first: Although the principle is typically sold as such, you're not actually taking a loan from yourself. If that were the instance, you wouldn't need to settle it. Instead, you're obtaining from the insurance provider and need to repay it with passion.

Some social media articles advise making use of cash worth from whole life insurance policy to pay down credit history card debt. When you pay back the car loan, a section of that rate of interest goes to the insurance policy business.

What are the tax advantages of Infinite Wealth Strategy?

For the very first several years, you'll be paying off the payment. This makes it incredibly difficult for your policy to accumulate worth throughout this time. Unless you can manage to pay a couple of to numerous hundred bucks for the next years or even more, IBC won't work for you.

Not everyone ought to depend exclusively on themselves for economic safety and security. Self-banking system. If you call for life insurance coverage, right here are some valuable pointers to consider: Take into consideration term life insurance policy. These policies offer insurance coverage throughout years with significant economic responsibilities, like home loans, pupil financings, or when caring for children. See to it to search for the very best rate.

How long does it take to see returns from Cash Value Leveraging?

Imagine never needing to stress over small business loan or high passion prices once again. What happens if you could borrow money on your terms and construct wealth at the same time? That's the power of unlimited financial life insurance. By leveraging the cash value of whole life insurance coverage IUL plans, you can grow your wide range and borrow money without relying upon conventional financial institutions.

There's no collection car loan term, and you have the liberty to choose the payment timetable, which can be as leisurely as settling the car loan at the time of death. This adaptability encompasses the servicing of the loans, where you can select interest-only repayments, maintaining the car loan balance flat and convenient.

Can I use Infinite Banking Benefits to fund large purchases?

Holding money in an IUL repaired account being credited passion can usually be much better than holding the cash money on deposit at a bank.: You've constantly imagined opening your own bakeshop. You can borrow from your IUL plan to cover the initial costs of renting an area, acquiring tools, and hiring team.

Individual fundings can be obtained from typical financial institutions and lending institution. Here are some crucial factors to take into consideration. Credit report cards can offer a flexible means to borrow cash for very short-term periods. Borrowing money on a debt card is normally very pricey with yearly percentage rates of interest (APR) typically getting to 20% to 30% or even more a year.

Latest Posts

Infinite Banking Concept Dave Ramsey

Becoming Your Own Banker

Creating Your Own Bank